Auto-Enrolment

July 09 2024

Learn about the new auto-enrolment scheme and what it means for you. Reading time 3 minutes

In this article, I have teamed up with Certified Financial Planner and Pensions expert Kelly-Anne Quinn of lifeplanning.ie to bring you up to speed on how auto enrolment will operate and what it means for your pension plan.

What is it?

Auto-enrolment is a government led retirement savings system for employees aged 23+ earning over €20,000 pa who are not part of a private workplace pension scheme.

Payroll deductions are expected to start in early 2025 impacting an estimated 800,000 Irish workers.

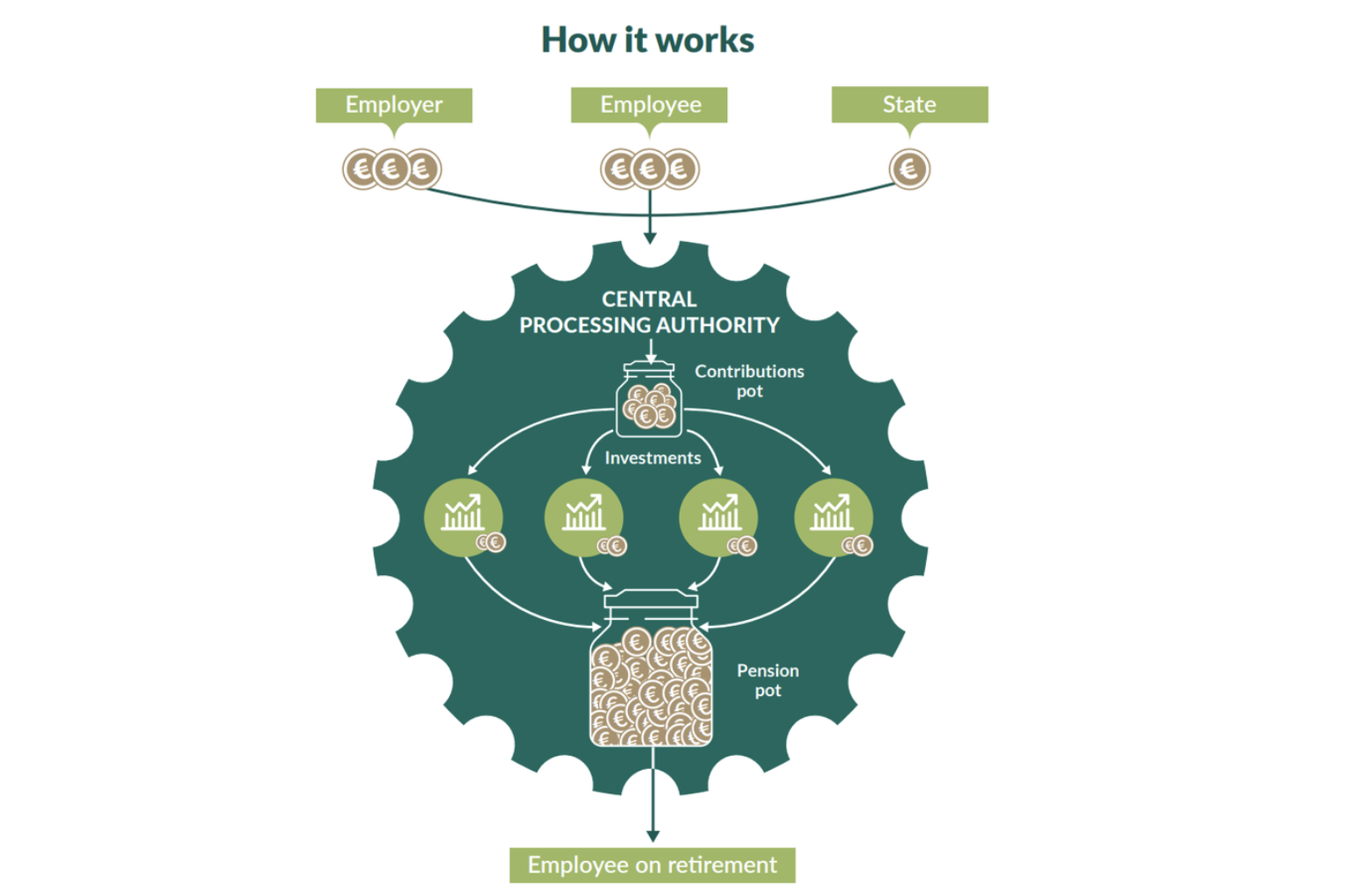

For every €3 saved by an eligible worker, +€4 will be credited to their ‘pot’.

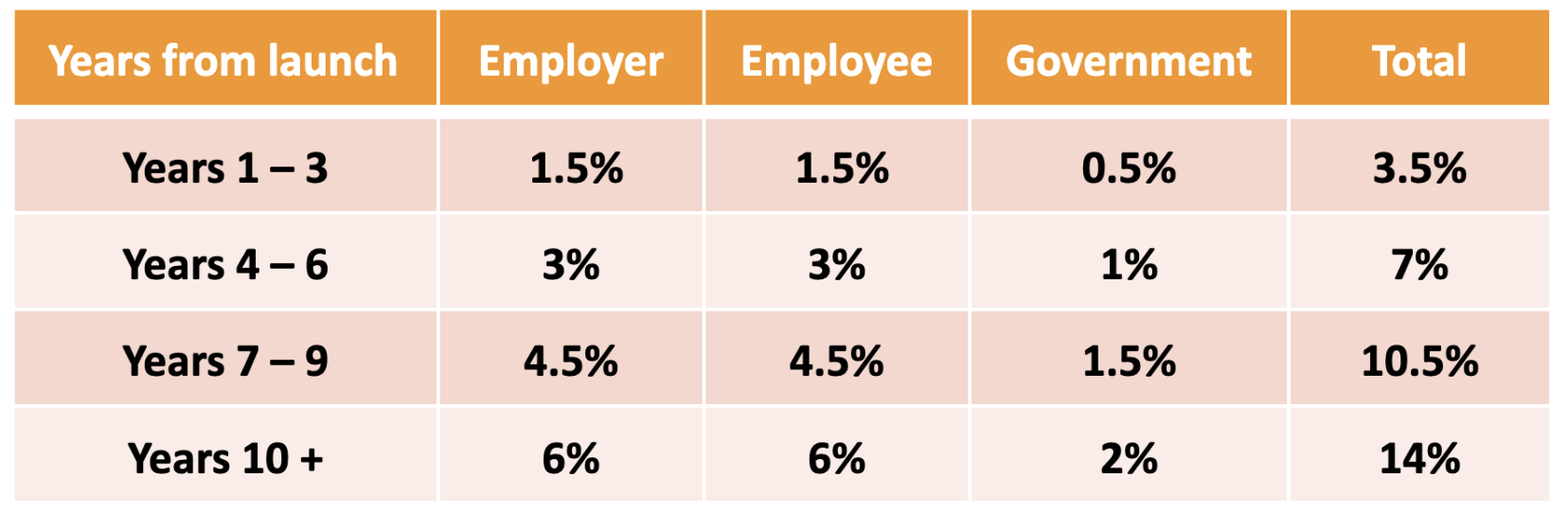

This +€4 is made up of a €3 matched contribution from the employer and a €1 contribution from the Government. The amount of the contributions will be based upon a percentage of the employees’ gross salary starting at a combined total of 3.5% and increasing to 14% as set out in the table below.

The government top-up is instead of tax relief on contributions that are ordinarily available with private pension schemes. The amount offered under auto-enrolment is equivalent to 25% tax relief on contributions.

Why do we need it?

Without additional pension funding many workers will rely on the State Pension as their only source of income at retirement. With an aging population this will put pressure on an already strained system. Auto-enrolment will increase pension awareness, overcome inertia with setting up contributions and assist with funding for retirement.

What is the Proposed Structure?

Automatically enrolled if:

- Earning over €20,000 per year across all employments

- Not part of a pension scheme or salary deducted PRSA

- Aged between 23 and 60

Can enroll if:

- Earning less than €20,000 per year across all employments

- Not part of a pension scheme or salary deducted PRSA - will be future minimum standards

- Aged outside of 23 and 60 bracket, between 18 and 66

Can Opt Out between months 6 and 8:

- After 6 months the employee will be allowed opt out – only has 2 months to avail of this option

- Employee contributions refunded only

- Employee will be automatically re-enrolled after 2 years

- Can choose to suspend contributions for a period of time

How will it be administered?

- Investment choice limited to default investment and three other funds, a low, medium and high risk option

- Contributions collected by National Automatic Enrolment Savings Authority (NAESA) and allocated to employee’s pot or fund

- Employee will have access to view fund on portal

- Benefits paid at State Pension Age

- No facility for advice

Potential Employee Issues

Tax Relief Inequity with private pension schemes – 25% equivalent Vs relief at marginal rate (20% or 40% depending on income)

Retirement Date restricted to State Pension Age

No salary and service tax free cash pension option

Limited fund choice

Contribution rates are fixed - no ability for employee or employer to pay increased contributions

If currently paying annual or single contribution will be automatically enrolled

What should you do now?

If you are not yet in a workplace pension scheme, now is the time to get informed and decide whether a private pension scheme is more desirable for you than auto-enrolment.

Which option is right for you will depend upon many factors.

Important considerations are your current and potential earnings and what employer contributions are on offer through an existing workplace pension scheme. Other considerations will include what level of flexibility and advice you’d like to have alongside your pension plan.

Based on the 25% equivalent tax relief on offer, auto-enrolment may be a better option for those paying income tax at 20%. Those paying income tax at 40% will likely do better under a private pension scheme arrangement. As always, get informed, take advice and act sooner rather than later to ensure that you implement the right choice for your unique circumstances!

For financial coaching and education, book a free discovery call to find out how Money Coaching Ireland can support your retirement plans and overall financial well-being.

For advice on private pension provision, contact Kelly-Anne Quinn of lifeplanning.ie

Important Information about Money Coaching Ireland’s BLOG

The material contained in these blog posts is intended for educational and entertainment purposes only. No responsibility is taken by Money Coaching Ireland for actions taken or not taken by individuals as a result of reading/watching/listening to these posts. Money Coaching Ireland recommends that individuals seek professional advice prior to making any significant financial decisions.

Subscribe to our mailing list

We would love to keep in touch by sending quarterly newsletters, monthly money tips and occasional updates about promotions and events we may be running. We will never sell or lease your details and you may unsubscribe at any time. You can find out about how we store and protect your information in our Privacy Policy.

By signing-up to receive updates you agree with the storage and handling of your data by Money Coaching Ireland and its trusted service providers. Read our Privacy Policy.