Ever worked in the UK?

June 21 2024

If you or someone you know worked in the UK, you may be entitled to a UK state pension. Read on to find out if you qualify and how to optimise that pension income in retirement.

If you worked and paid national insurance contributions in another country, you may be entitled to a state pension from that country at retirement age. At the very least, your contributions can count towards getting a better state pension in the country where you retire.

It is important to make contact with the relevant government department in the country where you worked. You should be able to request a ‘contribution' or 'forecast' statement and information about your options including the potential to make additional voluntary contributions. This practice known as ‘purchasing years’ is aimed at boosting your state pension income in retirement.

If like many people in Ireland you spent time working in the UK, the pension benefits on offer are particularly generous. At present, you can receive a UK state pension without reducing your entitlement to an Irish contributory state pension.

Here are some useful facts about the UK state pension:

you need three years* consecutive contributions to be eligible to ‘purchase years’

you need a minimum ten years contributions to be entitled to any state pension from the UK on retirement

40 years national insurance contributions or credits will entitle you to a full UK state pension currently £11,502 annually (£221.20 per week)

if you have less than 40 years and more than 10 years contributions, you will be entitled to a pro-rata pension. For example someone that has 20 years contributions, would be entitled to a 20/40th or half of the full state pension (£5,751 pa)

your UK state pension becomes payable from age 66 to 68 depending on your date of birth

\it is worth checking your eligibility even if you have worked for less than 36 months in the UK as some clients have qualified having only worked for 2.5 years in the UK*

Once you have established eligibility by virtue of a state pension forecast, you will have the opportunity to ‘purchase additional years’ to bring yourself up to the 10 year requirement and beyond.

Ordinarily, you can fill gaps in your national insurance record by purchasing the proceeding six years and then contributing on a go forward basis until you reach the state retirement age.

Following changes to the UK state pension, there is a window of opportunity to purchase ten additional years between 2006 and 2016. This opportunity closes on April 5th 2025.

This deadline has already been extended a number of times so it is unlikely to be extended again. Additional years need to be paid for in advance of this deadline. As the process can take some time, urgent action is needed if you believe you may qualify!

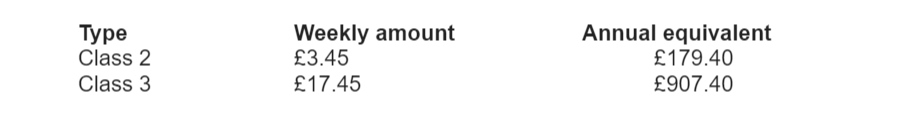

The cost of the ‘buy-back’ for the current UK financial year is set out in the table below - £179 per year for class 2 and £907 per year for class 3.

Recently, some clients living and working in Ireland have been quoted class 3 contribution purchase rates. This can be queried with the UK International Pensions Centre and you should be able to get a revised quote based on class 2 contribution purchase rates. So act now to check your eligibility and ensure your voluntary national contribution payments are processed in advance of the April 2025 deadline!

For support with claiming your UK pension or other financial goals, book a free discovery call today 💻💸

Important Information about Money Coaching Ireland’s BLOG

The material contained in these blog posts is intended for educational and entertainment purposes only. No responsibility is taken by Money Coaching Ireland for actions taken or not taken by individuals as a result of reading/watching/listening to these posts. Money Coaching Ireland recommends that individuals seek professional advice prior to making any significant financial decisions.

Subscribe to our mailing list

We would love to keep in touch by sending quarterly newsletters, monthly money tips and occasional updates about promotions and events we may be running. We will never sell or lease your details and you may unsubscribe at any time. You can find out about how we store and protect your information in our Privacy Policy.

By signing-up to receive updates you agree with the storage and handling of your data by Money Coaching Ireland and its trusted service providers. Read our Privacy Policy.