Excited but Nervous?

May 05 2021

If you are excited about Ireland's re-opening but nervous about what it might do to your financial situation, read on to discover a simple framework to successfully navigate this transition. Reading time 2 minutes.

In the celtic calendar, the start of May or Bealtaine heralds the arrival of summer and the beginning of the light half of the year.

As Ireland moves forward with the easing of restrictions, we can celebrate more than just the return of daylight. As we are filled with hope for a brighter future, there may also be a certain amount of trepidation not least when it comes to the likely impact on our wallet.

You may have found yourself actively saving, reducing debt or even just getting by more easily than before due to the limited opportunities that were available to spend during the pandemic.

The reopening of hospitality, personal services and travel is exciting, however, some of us may worry about its potential to undermine the gains we have made with our financial situation.

Worry and anxiety are common emotions when it comes to money.

Instead of just ignoring these emotions and carrying on regardless, it is important to acknowledge them so that they don’t end up driving our behaviour in a way that is detrimental to our financial well-being.

Once you have acknowledged and accepted them, it will be easier to address your worries in a detached and creative way. Solutions and ways of being will emerge that mean you can embrace the freedoms that will come from the lifting of the restrictions without jeopardising your financial security.

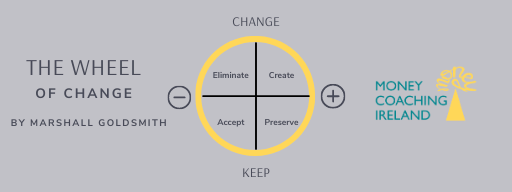

How this looks for each of us will be different. A framework that can be used to work through this transition is Marshall Goldsmith’s ‘Wheel of Change’.

Emerging from the pandemic and into a post-covid world, using the Wheel of Change for your financial situation may look something like this -

➕ Who is the new me I want to create? (adding/inventing)

- I am building my income using my skills and talents.

- I spend consciously and wisely on things that I need and things that bring me joy.

- When I travel and holiday, I fund it responsibly and not from over-the-top credit card spending.

➕ What is the old me I want to preserve?(improving/maintaining)

- I actively save for my future by building my income and consciously spending.

- I enjoy nature and amenities available locally without always having to travel further afield.

- I cook tasty meals at home and bring delicious picnics and snacks when I go out and about.

➖ What do I want to eliminate? (eradicating/reducing)

- Worry that I won’t have enough money to live securely and freely.

- Mindless spending to fulfill a perceived lack or to ‘keep up with the jones’.

➖ What do I need to make peace with? (delaying/making peace)

- Postponing certain purchases until I’m more financially secure.

- Delaying starting/increasing investments/pension contributions until I boost my income further/repay debt.

What you put under each heading or in each of the four segments of the circle will be unique to you so take out that pen and paper and start writing.

By doing this simple exercise, you will move more consciously into the post-covid world. You will build on the positive money habits you have developed during the pandemic yet be ready to savour the return of freedoms such as travel, eating out, live music events and (importantly for some 🙋♀️) getting your hair done. Bring it on!

Important Information about Money Coaching Ireland’s BLOG

The material contained in these blog posts is intended for educational and entertainment purposes only. No responsibility is taken by Money Coaching Ireland for actions taken or not taken by individuals as a result of reading/watching/listening to these posts. Money Coaching Ireland recommends that individuals seek professional advice prior to making any significant financial decisions.

Subscribe to our mailing list

We would love to keep in touch by sending quarterly newsletters, monthly money tips and occasional updates about promotions and events we may be running. We will never sell or lease your details and you may unsubscribe at any time. You can find out about how we store and protect your information in our Privacy Policy.

By signing-up to receive updates you agree with the storage and handling of your data by Money Coaching Ireland and its trusted service providers. Read our Privacy Policy.