Pensions and Meh…

April 01 2021

Find out why it’s in your interest to get informed about pensions and contribute what you can, whenever you can to build up that pot. Reading time 3 minutes.

When you mention the word pensions, a common reaction, particularly from those in their 20s and 30s is apathy. Or to put it another way – meh…

I want to encourage you to change your mantra from ‘Pensions – meh’ to ‘Pensions – hell yeah’. And, yes this applies to those of you in your 20s and 30s as well as those of you who may be a bit older…

I wrote recently about the importance of knowing your why. So why should you take the time to learn more about pensions?

Well, contributing to a pension is the most tax efficient way that you can save for your future. It's for you to envisage what having a lump sum at retirement and an income over and above the state pension will mean for you. And that's your why, it's personal to each of us.

In relation to the tax benefits of saving for a pension, the government is offering you income tax relief at your marginal rate (likely to be 40% if you earn over €35,300 gross annually*) on contributions that you make from earned income to a Revenue approved pension scheme (within certain generous age-related limits).

In my previous life, I worked in banking. I completed modules and CPD on pensions and knew about the tax advantages on offer. Despite this, I never sat down in my 20s and 30s and went "ok, so if I can find €120 per month to contribute to my pension, the government will effectively add €80 to that contribution resulting in a €200 per month pension contribution".

If I were to have that time back again, would I do it? Hell, yeah! Why? Well, if someone said to you that if you can save €1,440 this year, the government will turn it into €2,400 and also offer you tax-free growth on the fund, a tax-free lump sum on retirement and tax-free death benefits, would you do it? No brainer! Call it a pension and people go, yes you've guessed it, meh….

*Click here for details of income tax rates and bands in Ireland.

Why, do we go meh? Well, the tax benefits are there because you are being asked to put this money aside for a long time. When you are in your 20s and 30s, 65 or 68 can seem like a lifetime away.

Also, you have other priorities when you are younger. In your 20s, mainly socialising and travelling (pre-covid and speaking from personal experience here). In your 30s, saving for a home, possibly childcare and all the other expenses you incur if you do succeed in getting that home.

Add to this, the general busyness of life, lack of understanding about how pensions work, fear of getting fleeced by fees, fear around investment losses and it's unsurprising that people living in Ireland are generally lacklustre when it comes to pension provision.

I was fortunate that, despite not doing AVCs (additional voluntary contributions), the Bank was paying into a defined benefit pension scheme (a rare and almost extinct species unless you work in the public service) on my behalf and were also deducting contributions from my salary to pay for the benefits that I now stand to get at retirement.

If the Bank had asked me to contribute on a voluntary basis or left me to my own devices, I would have said, nah – can’t afford it. Knowing, l mean really knowing and appreciating, what I know now in terms of the benefits and tax advantages, I most definitely could afford it and more besides.

So, get informed about the pension options that may be available where you work. If you are fortunate to have access to a company pension scheme, it is likely that the fees you will pay are very competitive or the employer may even cover them on your behalf.

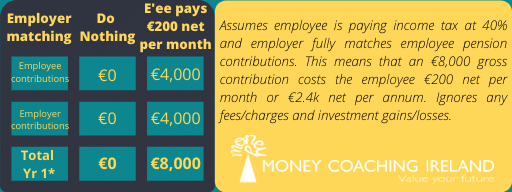

Some employers operate matched contributions. If your employer does, then by not contributing, you are losing out on far more than just the available tax relief.

See the example below where a net contribution of €2,400 from an employee paying the marginal rate of income tax (40%) translates into an €8,000 annual pension contribution.

Once you’re fully informed, it’s for you to decide what if anything you can afford to contribute and to take action. Your HR department should be able to provide you with the information you need. In addition, the Pensions Authority has some good information and resources available including a calculator that can be useful to figure out how much you need to contribute to arrive at a particular target income at retirement.

A major caveat to the calculator (and to the way pensions are sold generally for that matter) is that when you specify what you believe is a reasonable income on retirement, perhaps half of your current income for example, the amount you would need to save to reach that target income can be eye-watering, particularly, if you have left it a little late to start.

So instead of putting in what they can afford, people do nothing.

This is akin to saying "well because I can’t afford to save €1k per month right now, I’m not going to save a penny", which most people accept is nonsensical. Anything is better than nothing! Same goes for your pension, which is really just a long-term savings plan. A long-term savings plan with major tax advantages that is!

So, why not do yourself and your financial future a favour? When it comes to the topic of pensions, ditch the “meh” and respond with an enthusiastic “hell – yeah!”.

Important Information about Money Coaching Ireland’s BLOG

The material contained in these blog posts is intended for educational and entertainment purposes only. No responsibility is taken by Money Coaching Ireland for actions taken or not taken by individuals as a result of reading/watching/listening to these posts. Money Coaching Ireland recommends that individuals seek professional advice prior to making any significant financial decisions.

Subscribe to our mailing list

We would love to keep in touch by sending quarterly newsletters, monthly money tips and occasional updates about promotions and events we may be running. We will never sell or lease your details and you may unsubscribe at any time. You can find out about how we store and protect your information in our Privacy Policy.

By signing-up to receive updates you agree with the storage and handling of your data by Money Coaching Ireland and its trusted service providers. Read our Privacy Policy.