To AVC or not to AVC?

July 02 2024

Get informed about Additional Voluntary Contributions and decide if and when you can start contributing. Reading time 3 minutes.

Additional Voluntary Contributions or AVCs allow you to increase the amount of benefits you receive at retirement by paying extra contributions now.

An (AVC) pension allows members of workplace pension schemes to build up additional pension benefits over and above those provided by their workplace scheme. Think of it as topping up your pension savings.

AVC schemes are designed to sit alongside the main workplace pension scheme.

With an AVC pension, the contributions are usually deducted from your salary and sent to the pension scheme by your employer.

Most AVC schemes work on a ‘Defined Contribution’ (DC) basis. You make contributions which are invested to provide an additional pension pot at retirement.

When you can begin taking money from this pot depends on the rules of the AVC scheme you are in. Most people will take money from the AVC pot at the same time or after you begin taking income from the main scheme. The exact timings will depend on your scheme’s rules.

The value of your AVC pension pot will depend on:

- how much you’ve contributed to the AVC scheme

- how long each contribution has been invested

- how your investments perform over time

So why should you take the time to learn about AVCs and see if you can start contributing?

Saving for retirement from the income you have now makes good financial sense.

What makes pensions and AVCs particularly attractive are the generous tax benefits on offer.

As I’ve said many times before, pensions are the best tax scheme in the world, bar none 💸💡

It is important to fully grasp the tax benefits so that you can make an informed decision about whether AVCs are for you right now or not.

Tax relief on contributions is available at your marginal or higher rate of tax. This means that the tax savings available are more generous for anyone paying income tax at the higher rate of 40%.

Click here for details of income tax rates and bands in Ireland.*

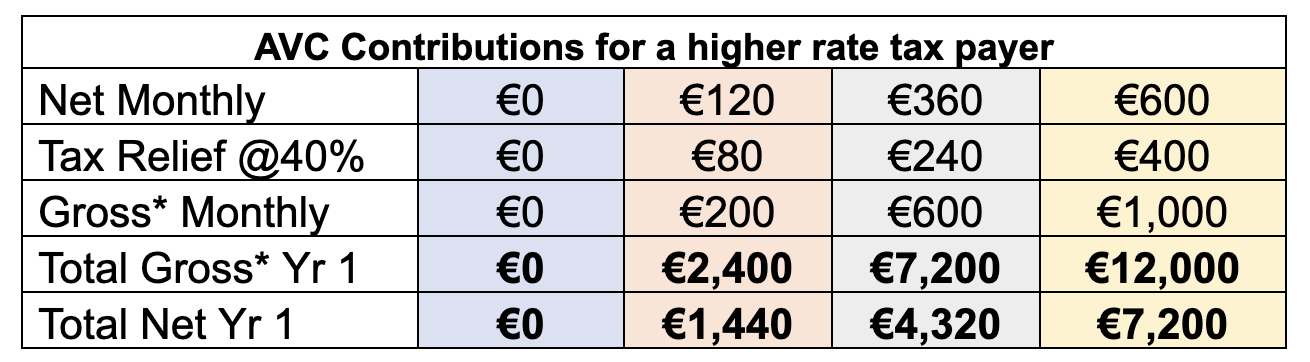

If you are a higher rate tax payer, this effectively means a *67% boost** on net contributions that you make to a Revenue approved pension scheme (within certain generous age-related limits).

What this means in money terms is outlined on the table below for four different AVC levels ranging from zero to €600 net per month.

\Ignores any fees and charges plus investment gains and losses.*

The tax relief on AVC pensions works in the same way as your main pension. This means that in addition to tax relief on contributions, you get tax free growth on the funds invested as well as a tax-free lump sum on retirement.

Once you understand the tax benefits of AVCs, it’s for you to decide what, if anything, you can contribute right now. Factors to consider are -

- Projected pension and other income in retirement as things stand without AVCs. If you intend to retire early, have gaps in your employment or have big plans for when you retire, then additional voluntary contributions (AVCs) are a great option.

- Affordability and other priorities. If you want to buy a home, for example, you may choose to postpone AVCs for now to save for your deposit and maximise the amount of money you can borrow by way of a mortgage.

- Investment options available. Your pension and AVC pot contains your money. It’s up to you to ensure that you are satisfied with how the funds are invested on your behalf.

The earlier you start AVCs the better, however, it is always better late than never when it comes to pension savings.

Once you’re fully informed, take action by contacting the broker affiliated to your workplace pension scheme or seek independent financial advice. Together, you can decide an additional voluntary contribution amount that’s right for you. You can also discuss how you want your funds to be invested and choose an investment strategy with which you are comfortable.

Your pension is a long-term savings plan. A long-term savings plan with major tax advantages that is!

Your workplace pension is designed to accumulate a pot of money for you to access in retirement. AVCs are simply a mechanism to increase the amount you are saving. The result? Assuming your investments are well managed, then a larger combined pot in retirement 💰💰

So to AVC or not to AVC? Once you’re fully informed and have sought professional advice, that’s for you to decide!

Important Information about Money Coaching Ireland’s BLOG

The material contained in these blog posts is intended for educational and entertainment purposes only. No responsibility is taken by Money Coaching Ireland for actions taken or not taken by individuals as a result of reading/watching/listening to these posts. Money Coaching Ireland recommends that individuals seek professional advice prior to making any significant financial decisions.

Subscribe to our mailing list

We would love to keep in touch by sending quarterly newsletters, monthly money tips and occasional updates about promotions and events we may be running. We will never sell or lease your details and you may unsubscribe at any time. You can find out about how we store and protect your information in our Privacy Policy.

By signing-up to receive updates you agree with the storage and handling of your data by Money Coaching Ireland and its trusted service providers. Read our Privacy Policy.