You've got mail

January 04 2022

If the reality of Christmas excess has been compounded by the arrival of your December credit card bill, read on to discover what you can do to deal with it sensibly. Reading time: 2 minutes.

Around now your December credit card statement will be arriving, if not through your letterbox, then into your inbox or appearing on your banking app.

If you weren’t one of those savers who had the cost of Christmas well covered in advance, then you may be looking at a pretty hefty balance, particularly if your income has been reduced or disrupted as a result of Covid.

Instead of burying your head in the sand and allowing the monthly interest to rack up, follow the three steps below now.

And no, one of them is not to cut up the credit card. This is sometimes appropriate. Often, however, it is akin to throwing out any leftover chocolates, crisps, desserts or alcohol only to start buying them again before January is out.

If your situation requires further action, consider the three longer-term strategies outlined further down.

- Review your statement and appreciate the items purchased. Acknowledge the joy they brought and continue to bring to you and your giftee. Any purchases made for yourself that you regret, consider returning or exchanging them if that’s still a possibility.

- Switch to save on your utility bills so you will have more disposable income available to pay off the balance. Check whether you are out of contract on your light and heat, broadband, phone or entertainment package. If you are, then use bonkers, switcher or powertoswitch to select the best value supplier.

- Think about ways you may be able to generate more money to pay off the balance quickly. If you are employed, can you do overtime or extra shifts? If you are self-employed or have a side-line business, can you generate more sales in the short-term or postpone certain purchases?

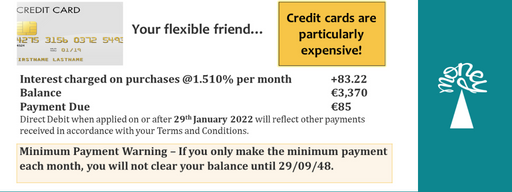

Most credit card providers will offer 56 days credit from the date of purchase. This means that you do have a little breathing space before you start to pay interest, which can be very hefty (see example below).

It’s not always possible to generate enough money to deal with your outstanding balance in the short-term.

If you find yourself in this situation, consider strategies such as

moving any larger purchases to an instalment plan at a lower interest rate (contact your provider to see if they offer this service);

moving your balance to an *alternative credit card provider** ideally one offering a zero percent introductory rate (be aware that if your current financial situation has deteriorated, a new provider may not take you on);

borrowing from a friend or family member to clear the balance (this is where the cutting up option may need to be given serious consideration as the bank of family and friends, if available to you, is unlikely to offer support a second or third time around!).

*The CCPC comparisons and calculators are great tools to support you if you are considering switching provider.

If your debt problems have become overwhelming, don’t bury your head. Talk to your lender and seek assistance from family or friends. Mind your mental health and if you need to, get in contact with your GP.

Support and information are available from the CCPC, Citizens Information, MABS, the Insolvency Service of Ireland, the HSE and others.

Important Information about Money Coaching Ireland’s BLOG

The material contained in these blog posts is intended for educational and entertainment purposes only. No responsibility is taken by Money Coaching Ireland for actions taken or not taken by individuals as a result of reading/watching/listening to these posts. Money Coaching Ireland recommends that individuals seek professional advice prior to making any significant financial decisions.

Subscribe to our mailing list

We would love to keep in touch by sending quarterly newsletters, monthly money tips and occasional updates about promotions and events we may be running. We will never sell or lease your details and you may unsubscribe at any time. You can find out about how we store and protect your information in our Privacy Policy.

By signing-up to receive updates you agree with the storage and handling of your data by Money Coaching Ireland and its trusted service providers. Read our Privacy Policy.